Bitcoin is going to zero

By Hamish Douglass of Magellan

It’s annual update time at Magellan and Hamish has finally lost his rag with clients continually asking him about bitcoin.

So he emailed the entire Magellan database this “story” about why Bitcoin is a bad idea. It’s one for the archives. Italics our responses, everything else is the Magellan gobbledygook

CRYPTO GOLD

Perhaps the best way to show how weird all this is to imagine if someone were to create crypto gold.

Imagine this journey starts via a proposal to launch a gold exchange-traded fund backed by one metric tonne of gold (35,274 ounces). At market prices, the assets of the new gold ETF are worth US$65 million. The gold ETF has one million units on issue so the initial price per unit is US$65, which should move in line with the gold price. The new gold ETF is named GOLDCOIN and listed on a reputable stock exchange. There is nothing revolutionary about GOLDCOIN other than it offers an easy way for investors to trade in gold.

Right off the bat, misconceptions. Bitcoin was worth zero at launch. It simply was easy to exchange and send around the globe and in the early days it was easy (but not free) to mine on your computer. So, a group of cryptography enthusiasts did so. They shared the coins with each other and tested the software. There was no team, no marketing, no valuations, just software.

A genius colleague, Hideyoshi Son (excellent, virtuous, good and respectable), proposes some enhancements to GOLDCOIN:

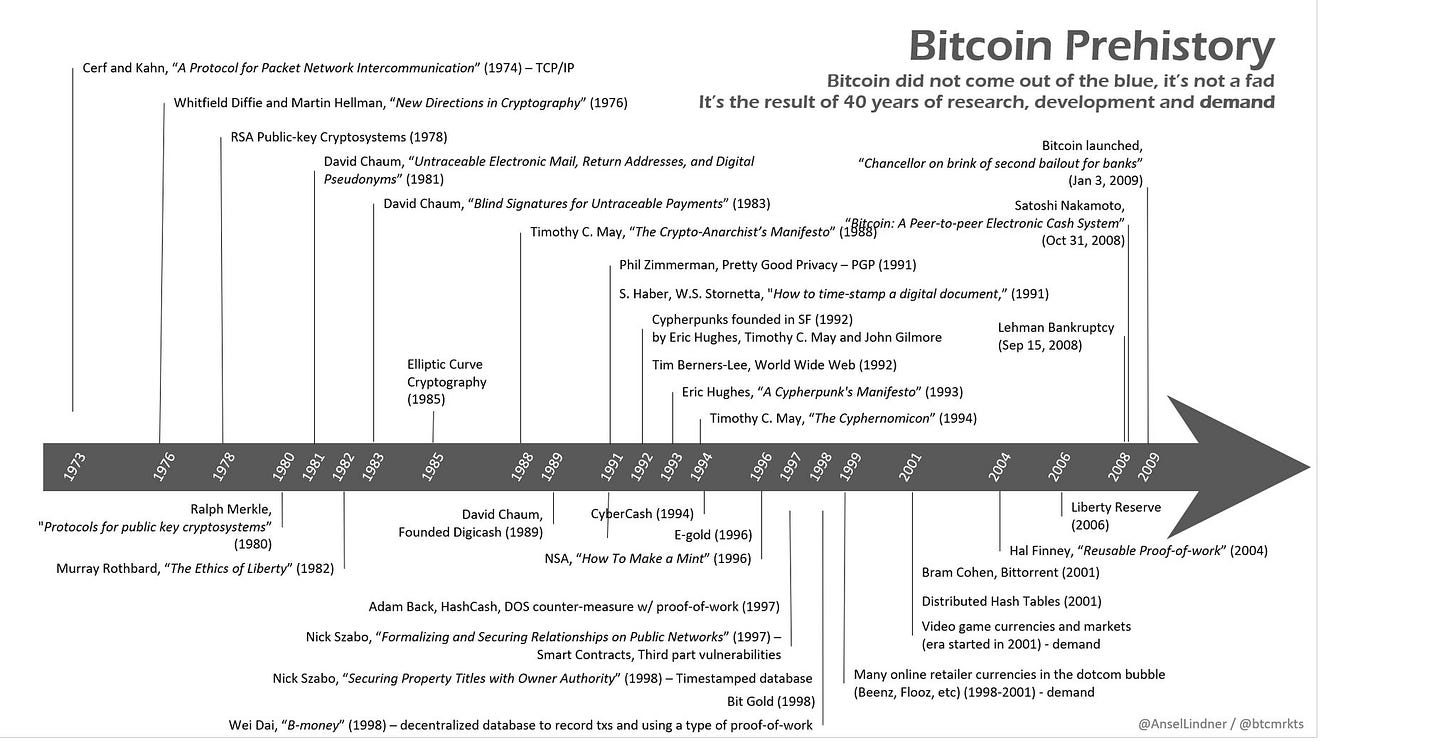

At no point did such a thing happen. In fact, the protocol incorporates some of the most sophisticated mathematical discoveries of the last 200 years. The more recent contributions to the protocol are listed below. Including a sprinkling of Nobel Laureates for good measure.

The total amount of gold in the ETF is fixed at one metric tonne;

The total maximum number of units that can be issued is capped at 20 million units (rising from one million to a maximum of 20 million over time); and

New units are issued to people who solve a complex mathematical riddle.

On review, we run into a problem: that the rules of the reputable stock exchange ban the issuing of units to new investors for no consideration. Not to be deterred, Hideyoshi Son says we need to create a mechanism to trade our product outside the system so we won’t be constrained by stock exchange rules or, for that matter, laws or regulations. He suggests that units in GOLDCOIN be recorded on a new fully distributed ledger known as the blockchain. This form of ledger changes everything, he argues. Most importantly, a blockchain ledger gives reliable proof of ownership but also total privacy – no one can find out who owns units in GOLDCOIN. Our new product is outside the constraints of the current system and doesn’t have to comply with any anti-money-laundering laws, exchange rules, consumer-protection laws, etc. This provides GOLDCOIN with an enormous potential market.

A tired argument that died with the Silk Road. All major exchanges now require full KYC. Using bitcoin or a blockchain is manifestly the worst possible thing to do when committing a crime since the digital trail it leaves behind (in the blockchain) are there for all to see.

We launch GOLDCOIN on the new blockchain but things don’t go as planned. Each time we issue a unit to a person who solves the riddle, the value of a unit of GOLDCOIN falls. We are so stupid.

This is the most fundamental error of the Magellan argument and goes to the heart of bitcoin. Producing a bitcoin has a cost. Miners must invest in capital and electricity (and a lot of it) to produce bitcoin. Over time the mining cost and the price finds an equilibrium. As price rises, more miners come onto the market, mining difficulty rise and the cost of production increases. Similarly, as price falls and miners leave the market, difficulty falls. Miner issuance does not affect price over time, particularly as the exact supply schedule is known by all participants in advance.

Obviously when we create units for no consideration the value per unit falls. In fact, once the total number of units reaches the maximum 20 million allowed, the value of GOLDCOIN will fall by 95% on a per-unit basis.

FALSE. Again, there absolutely is consideration. The cost of mining. That cost is the proof of work, that all participants can see. It stops people cheating the system.

Hideyoshi Son sees the flaw in our product. The problem, he says, is that the asset backing of GOLDCOIN is fixed at one metric tonne of gold. The solution, I suggest, is to increase the asset backing up to a maximum 20 metric tonnes of gold, in line with the maximum number of units we can issue. If we do this, each unit will always be backed by 0.035 ounces of gold. We now have the perfect product, a digital form of gold where each unit is always backed by the same quantity of gold, that can be traded anonymously on the blockchain outside of the reach of authorities.

Straightforward nonsense in an attempt to make a very bad explanation hang together.

Hideyoshi Son says so far so good but we need to do something more radical. He says the proposal to fully back the product with gold won’t work under the magic he is proposing where crypto mining and the solving of a complex riddle lead us to create another unit of GOLDCOIN. He says if additional units are backed by gold, and paid for, then no one will be motivated to solve the riddle. He says the solving of a complex problem and setting a maximum limit on the total number of units that can be issued is essential to the psychology behind the illusion. He says to solve the problem of dilution resulting from issuing new units we need to remove the physical gold underpinning the value of GOLDCOIN. By removing any tangible asset backing from our product there can be no dilution when issuing new units – you cannot dilute something that has no value. He argues that people can be convinced that GOLDCOIN, with a capped number of units to be issued, is a new form of digital gold. Sceptical me asked: “How can something that is imaginary, with no tangible value, be more valuable than our original product backed by one metric tonne of gold?”

There is no dilution. That is the absolute point. From the start there were only ever 21 million bitcoin with an absolute, public and vefifiable issuance cycle. As to backing, the backing is the proof of work. Anyone can check the absolute number of calculations that have gone into producing the bitcoin blockchain with reference to their own node. It is public information.

To prove the point, that is an extract from a bitcoin node. See the “log2_work=92.958880”. That is the total number of calculations miners have performed since launch. That number is the largest continual calculation ever undertaken by humanity. A feat casually ignored here. Those calculations have a cost…..the production cost of bitcoin.

9,602,708,861,090,850,000,000,000,000 is the current proof of work on 21 July 2021.

Hideyoshi Son, a master of human psychology, says we have the perfect circumstances to create an illusion, one that defies the laws of economics and logic:

Post the financial crisis of 2008-09 and the recent pandemic, millions of people are worried that the world’s major currencies are being debased by excessive ‘money printing’ by central banks. He says placing a cap on the maximum number of units of GOLDCOIN that can be issued plays into these fears.

They are not “fears”. They are facts. The Australian Money supply doubles every six years. Scarce assets are valuable but how do you prove they are scarce? You never could until now.

He has inverted the law of dilution to a law of scarcity;

No. There is no dilution. New bitcoins have a real cost to the producer, the issuance schedule and total supply has been known since launch in 2009 and has never wavered and never will. You cannot say that for any currency, any stock or any other asset for that matter.

Removing any tangible value from our product removes any anchoring bias around its actual value;

Wrong. There is an absolute cost to production. That cost is verifiable to the consumer. I keep saying it because the proof of work is crucial. Bitcoin’s are not free to miners or anyone else. The cost is real and verifiable.

The fact that ownership is untraceable, and the fact that it can be traded, makes units the ultimate medium of exchange for illicit activity;

Wrong. It is not and never has been untraceable. Indeed, it is vastly more traceable than assets in the current financial system. Exactly why every Central Bank wants to create something similar.

The riddle-solving (or mining as it was to become known) to win a newly created unit and the dazzle of the blockchain give our product mystical properties;

Social media, with the right clickbait, will fuel unconstrained and widespread promotion of our product – no need to worry about legal constraints such as laws that demand a prospectus. He is most excited by a platform called TikTok due to its ability to attract a generation of first-time speculators. He guesses that as the price is driven up, more and more speculators will get on board. The mainstream media will become infatuated, thus giving GOLDCOIN legitimacy; and

TikTok hasn’t existed for 90% of bitcoin’s existence. Legitimacy came from value creation and bitcoin has created an enormous amount value for its investors over almost any time period you choose.

Bitcoin is not like Magellan. It has no marketing department, no friends at the Fed, no friends at the Fin Review. It must speak for itself 24/7 in face of unending criticism. No help is required either.

As momentum grows, more people will be attracted to this unregulated system of easy money. Entrepreneurial people will offer services such as exchanges and crypto wallets.

Easy money? Try mining a bitcoin and good luck. Otherwise, correct. It’s growing like the internet did.

Hand it to Hideyoshi Son, a true genius. He has created the illusion of scarcity and hence value from something that has no intrinsic worth. Our product, he argues, will become the world’s greatest Ponzi scheme. Some call his scheme a new digital currency or even crypto gold – highly amusing given that there is no gold backing our product.

There is no “illusion”. Bitcoin is provably scarce and you can prove it yourself. Almost nothing else on the planet is.

“No intrinsic worth”. False. Bitcoin is costly to produce, a cost that can be verified independently.

The above illustration clearly is absurd and defies logic. But this imaginary product has attributes that are similar to those of Bitcoin. In our opinion, it is virtually certain that, in time, cryptocurrencies that are not backed by assets or by a central bank will become worthless. It is concerning, but not surprising, that regulators have not put in place appropriate regulations and consumer protections. They should.

Correct. They should. 95% of cryptocurrencies will go to zero and are indeed worthless because they do not have the backing of the energy that is required to produce them. Not so bitcoin, hence its outperformance of absolutely everything, including all of Magellan's products.

Cryptocurrencies are operating outside the system, which enables their use for money laundering, terrorism, ransom, cybercrime and other illegal activity. It is inevitable that the regulators will catch up, and the day of reckoning may be approaching sooner than people expect. It is likely that this will end in tears for many people.

So is cash. More importantly, the number one money laundering tool of the world is and remains the United States Dollar which is why the traditional financial industry has been fined billions and billions of dollars in the last 10 years for facilitating it.

That said, while we are sceptical about the value of today’s cryptocurrencies, we believe in blockchain technology and think it will have profound implications and disrupt many industries. We expect that most central banks in time will issue digital currencies and private asset-backed cryptocurrencies (or stable coins) will enter more common use. With the explosion of government debt following the pandemic amid the money printing of central banks, the case for a gold-backed cryptocurrency grows by the day. Maybe there is some truth in GOLDCOIN after all.

The icing on the cake. We think blockchain good, we think bitcoin bad. I am afraid they are inseperable. Simply, Magellan has done zero homework here and has casually attacked a product that they find annoying because clients continually ask about it.

They won’t stop asking either.